Character—may perhaps consist of credit history and reports to showcase the reputation of the borrower's potential to satisfy financial debt obligations in the past, their perform practical experience and revenue stage, and any fantastic authorized issues

Look at lender capabilities. The loan with the lowest charge and inexpensive monthly payments is typically the best loan offer. If you have multiple promising gives, Assess Exclusive functions to break the tie. Some lenders have credit rating-constructing instruments, unemployment safety or speedy funding.

You should utilize the house equity line of credit rating (HELOC) to the down payment with your new household while you wait for your recent house to offer. Once it does, you can pay off the HELOC.

You might be able to finance both equally your to start with and next home loans with the exact lender. Actually, some lenders supply a discount for borrowing the two loans with them, however you might come across an improved deal applying different lenders.

There are a variety of loan systems specifically geared towards homeowners with large LTV ratios. You will find even some applications which dismiss loan-to-worth altogether.

You'd even now should be underwritten by the second lender, as you'll the initial, and acquire acceptance and shut on the loan simultaneously the main house loan closes. You could even must pay out an appraisal charge to that lender too.

The first mortgage loan stays within just conforming loan limitations, even though the rest of the order price tag is shared concerning the 2nd house loan as well as your deposit.

Normally, this sort of loan originates from a formal down payment support application provided via a condition housing finance authority. If it does, it typically has realistic interest prices, and may even be forgivable following a several years.

“Professional verified” implies that our check here Financial Critique Board comprehensively evaluated the post for precision and clarity. The Critique Board comprises a panel of monetary authorities whose aim is in order that our content is always aim and well balanced.

Bankrate follows a stringent editorial coverage, so you're able to rely on that we’re Placing your passions initially. Our award-profitable editors and reporters build honest and accurate content material that may help you make the proper monetary conclusions. Key Principles

Paying it off in whole or in part may also help do away with desire payments. Once settled, the HELOC continues to be readily available for long run use, supplying financial adaptability.

An 80/10/ten piggyback loan is really a sort of loan that includes acquiring two home loans at the same time: A single is for 80 per cent of the home’s worth and the opposite is for ten %. The piggyback method allows you to avoid private house loan coverage or being forced to just take out a jumbo loan. Homeowners purchasing a fresh spot can undertake a variation over the piggyback system: utilizing a home fairness loan or credit history line for the second, lesser mortgage loan.

The rate normally printed by banking institutions for conserving accounts, income marketplace accounts, and CDs would be the once-a-year percentage yield, or APY. It is crucial to be aware of the distinction between APR and APY. Borrowers trying to find loans can estimate the actual fascination compensated to lenders based on their own marketed fees by utilizing the Fascination Calculator. To find out more about or to accomplish calculations involving APR, remember to pay a visit to the APR Calculator.

House fairness loans are typically mounted and HELOCs are generally variable rate loans tied to the key fee.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Gia Lopez Then & Now!

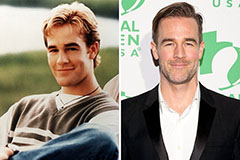

Gia Lopez Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now!